UNAIR NEWS – The emergence of deregulation in the field of bankruptcy law marked by the issuance of Perpu Number 1 of 1998 triggered the development of bankruptcy law in Indonesia in the last 25 years. The deregulation proved effective and became one of the legal instruments capable of returning creditors’ receivables to debtors.

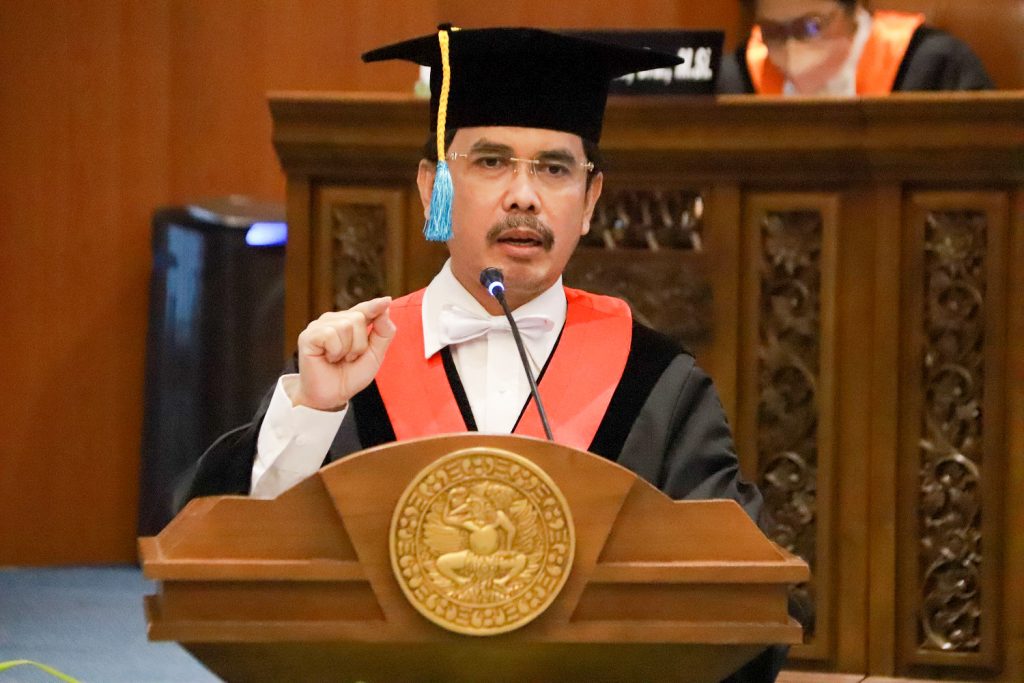

It was conveyed by Prof Dr M Hadi Shubhan SH MH CN during his inauguration as professor of Faculty of Law (FH) Universitas Airlangga (UNAIR) in the field of Bankruptcy Law. At his inauguration, he delivered a scientific oration entitled Characteristics of Indonesian Bankruptcy Law and Its Development as Legal Instrument for Debt Payment Recovery. The inauguration was held at Garuda Mukti Hall, Wednesday, August 10, 2022.

“In 50 years since independence, there have only been 175 bankruptcy verdicts. Meanwhile, in one year in 2021, there are more than 732 PKPU and bankruptcy cases,” said Prof Hadi who also serves as UNAIR Director of Student Affairs.

According to him, several characteristics unique to bankruptcy law in Indonesia are factors of effectiveness of bankruptcy rules or laws. Among other things, there is no requirement for an insolvency test in filing an application for bankruptcy against a debtor under bankruptcy law in Indonesia, and the establishment of a commercial court specifically intended to handle bankruptcy.

“This commercial court has a speciality, only adjudicating bankruptcy and PKPU, handled by judges who have special expertise in the field of bankruptcy, and it is mandatory for the bankruptcy or PKPU applicant to be an advocate,” added the 18th active professor of Faculty of Law.

Furthermore, the opening of private curator profession and the existence of a balancing legal instrument from bankruptcy, such as the legal instrument for Postponing Debt Payment Obligation (PKPU), is also a supporting factor.

Prof Hadi said that PKPU was indeed provided to facilitate the interests of debtors to avoid bankruptcy because PKPU can be submitted by the debtor when he estimates that he will not be able to pay his debt when it is due. Basically, the application is intended to restructure all debtors’ debts.

“Besides Garuda Indonesia, several giant companies have succeeded in restructuring all their debts through PKPU so they could escape bankruptcy are the Duniatex Group, Sritex Group, and Meikarta,” he said.

The function of bankruptcy law in Indonesia has also developed; as a tool to settle the bankruptcy of the debtor, as a tool to collect debts, as a tool to speed up liquidated company leading to dissolution, and as a tool to speed up the execution of a court or arbitration institution verdict. (*)

Author: Afrizal Naufal Ghani

Editor : Binti Q. Masruroh