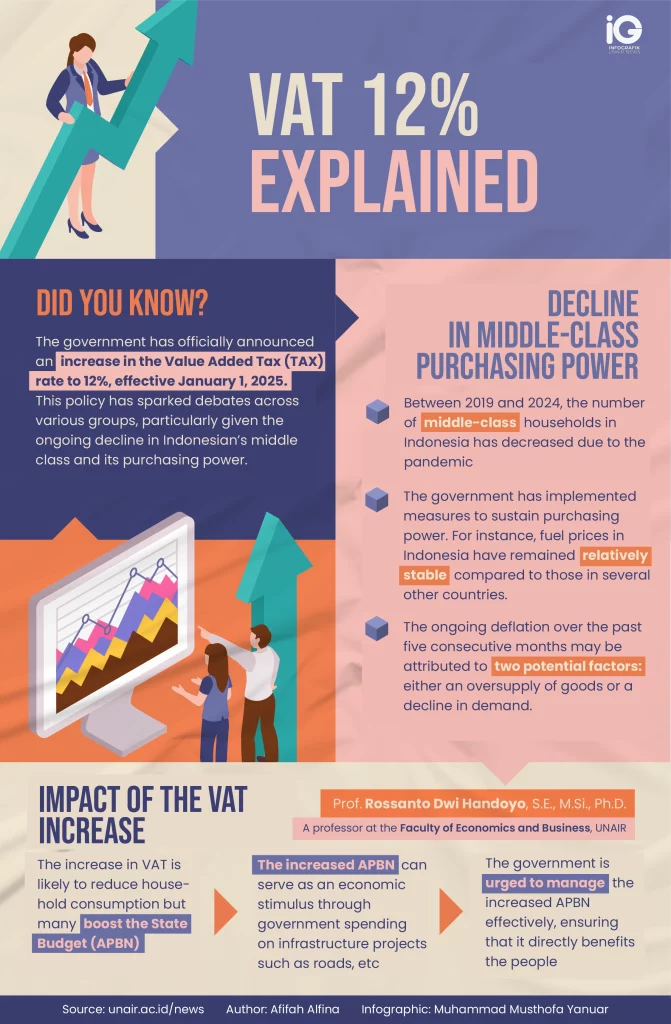

UNAIR NEWS – The government has officially announced an increase in the Value Added Tax (VAT) rate to 12%, effective January 1, 2025. This policy has sparked debates across various groups, particularly given the ongoing decline in Indonesia’s middle class and its purchasing power.

Decline in Middle-Class Purchasing Power

Between 2019 and 2024, the number of middle-class households in Indonesia has decreased due to the impact of the pandemic. The government has implemented measures to sustain purchasing power. For instance, fuel prices in Indonesia have remained relatively stable compared to those in several other countries. The ongoing deflation over the past five consecutive months may be attributed to two potential factors: either an oversupply of goods or a decline in demand.

Impact of the VAT Increase

The increase in Value-Added Tax (VAT) has had a significant impact on society. According to Prof. Rossanto Dwi Handoyo, SE, MSi, PhD, a professor at the Faculty of Economics and Business (FEB), Universitas Airlangga (UNAIR), this VAT hike is expected to reduce household consumption while simultaneously boosting state revenue (APBN). The increased APBN can then serve as an economic stimulus through government spending, such as infrastructure projects for roads, airports, and ports. Prof. Rossanto emphasized the importance of government efficiency in managing the APBN to ensure its benefits reach the public effectively.

Read also: