UNAIR NEWS – The Department of Accounting at the Faculty of Economics and Business, Universitas Airlangga (UNAIR FEB), continues to expand its international academic engagement through a Collaborative Teaching–International Guest Lecture in partnership with Universiti Teknologi MARA (UiTM). The event was conducted online on Tuesday (30/12/2025).

The session brought together scholars from UNAIR and UiTM to address key issues in accounting, finance, research methodologies, and sustainability. Open to the public, the lecture aimed to enhance academic insight and discussion in response to the demands of a digitalized and interconnected global environment.

Netnography as management accounting research approach in the digital era

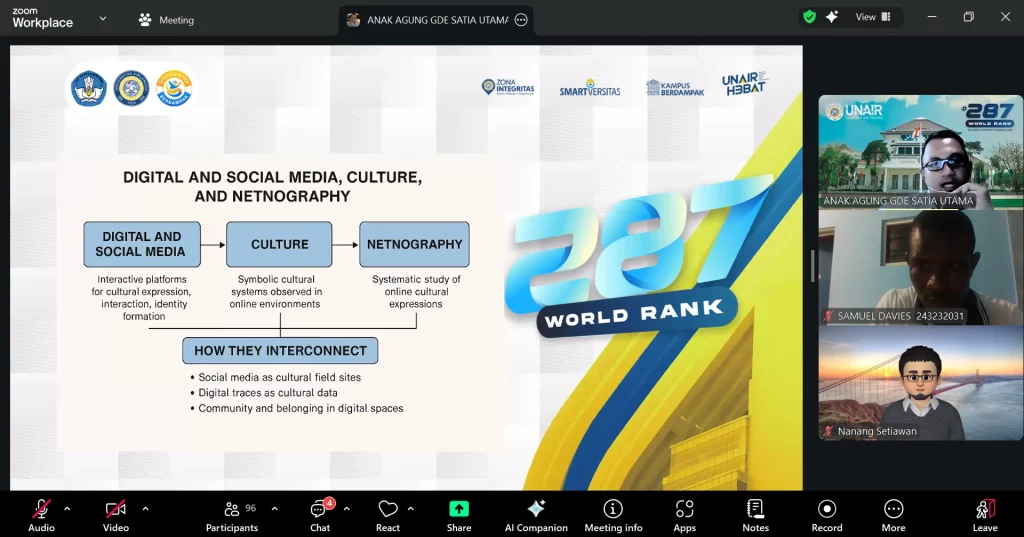

The opening presentation was delivered by Dr. Anak Agung Gde Satia Utama, SE, MAk, Ak, CA, of the Department of Accounting. He introduced netnography as a methodological approach in management accounting research, explaining that it examines cultural dynamics as they emerge within digital environments. He described netnography as part of digital anthropology, emphasizing its focus on naturally observing online communities to obtain more authentic data.

He noted that while netnography primarily concentrates on analyzing interactions within digital communities, it can be complemented by other research methods when deeper analysis is required.

“In some situations, researchers may seek a more comprehensive understanding of interactions and therefore add methods such as interviews. However, once physical interaction is included, the research can no longer be considered pure netnography. It becomes a mixed-method approach, as pure netnography is conducted entirely online without face-to-face engagement,” Satia Utama said.

Investment analysis and sustainability accounting

From Universiti Teknologi MARA (UiTM), Syamsul Samsudin and Oswald Timothy Edward presented on financial performance assessment and the role of investment analysis in linking accounting information to decision-making in capital markets.

Samsudin underscored the importance of evaluating corporate health through fundamental analysis, including the use of the 3M Model framework as a key performance indicator. He encouraged participants to recognize that financial analysis should extend beyond numerical data to include assessments of business quality and corporate governance.

“When making investment decisions, investors should not rely solely on profit figures. It is essential to evaluate the strength of a company’s business model, the competence of its management, and whether its financial indicators signal positive performance. Together, these factors help determine whether a company is truly in a sound condition,” Samsudin said.

Edward further explained how capital markets interpret accounting information, emphasizing that stock prices reflect future expectations. As a result, investors consider not only current earnings but also how accounting data signal a company’s growth potential and risk profile.

Meanwhile, Dewi Sriani, SA, MSc, from UNAIR discussed Environmental Management Accounting (EMA) as a strategic framework for integrating sustainability into business performance. She explained that EMA goes beyond environmental compliance. “EMA enables organizations to translate sustainability initiatives into measurable business outcomes and supports long-term strategic planning,” Sriani said.

Author: Kania Khansa Nadhifa Kallista

Editor: Ragil Kukuh Imanto